In 2016, we continued our journey of making Pin Payments the most flexible and user-friendly option on the market; one that bridges the gap between traditional payment facilities and the needs of today’s businesses.

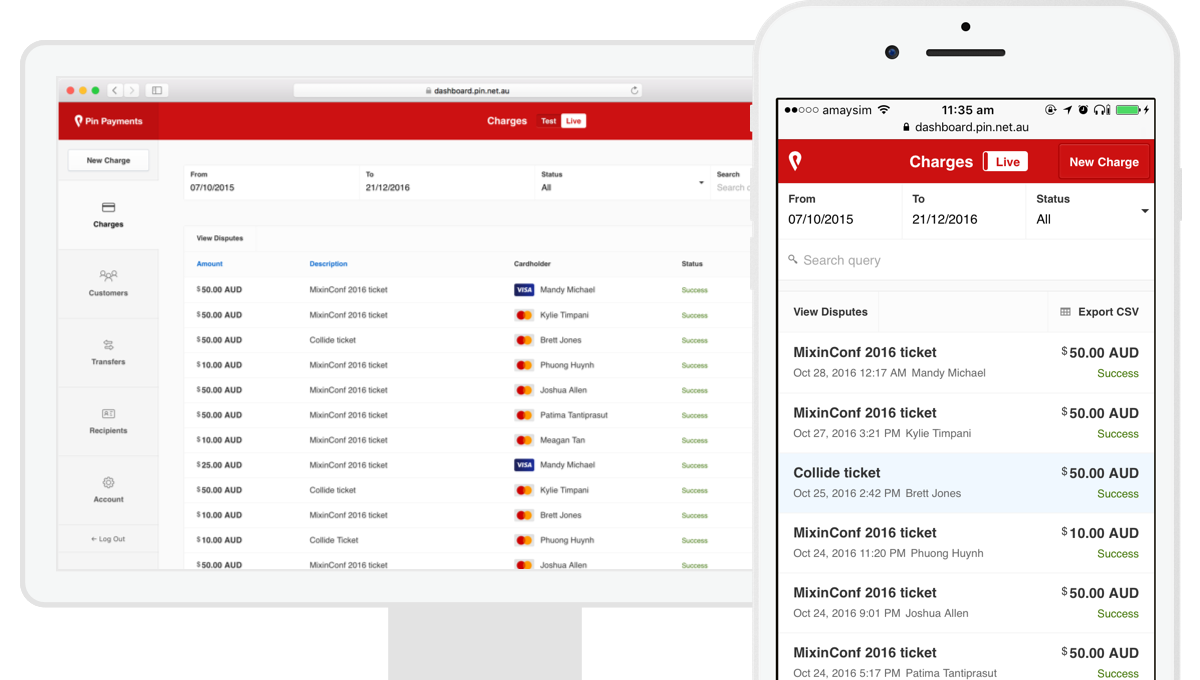

We started out with a redesigned, mobile-responsive dashboard, offering our customers easy access to their accounts from any device. This became the foundation for all our newest features and upgrades to your Pin Payments service.

Easy card authentication

Built in consultation with Mastercard, our easy card authentication feature quickly verifies your customer before you ship their order. This helps keep your business protected from any potential loss of revenue or product due to fraudulent transactions and chargebacks.

Secure customer storage

Our latest dashboard upgrade saw the addition of secure customer payment profiles. We handle all security, privacy and compliance on your behalf, supporting your business’s capacity for accepting recurring payments. Now you can offer your customers better service and peace of mind, knowing that their data is safe with you.

Flexible payment settings

Customer accounts can not only hold multiple payment cards, but give you the ability to request part-payments across different sources of funds. This smart, flexible feature means one less barrier to conversion, streamlining your checkout process and offering your customers the convenience of accessing their money, wherever it may be.

Zero-charge card authorisation

Previously, testing if a customer’s card is valid meant processing a live charge, but now you can use a pre-authorisation instead. This feature has been available through the API for some time, but now when you create a charge in your dashboard, you can opt to hold off on capturing the funds whilst ensuring that amount is available when you’re ready to bill.

Receipt updates

Style matters just as much as substance. We’ve been working on a more modern design for your electronic receipts, helping you maintain your brand’s credibility through a consistent and elegant visual style. Included are custom fields for your business’s logo and ABN, plus your customer’s card type, last four digits and charge date.

Payment metadata

Now when you issue a charge via the API, you have the option of adding extra details, such as order numbers or customer names. This makes it easier to cross-reference payments with orders, or even automate your payment tracking process entirely. This metadata can be viewed on charges in your dashboard. Best of all, this system is both customisable and flexible, meaning you decide what information is most valuable for your business to capture.