Business refunds have become more commonplace since the emergence of COVID-19. As such, there may be times when your business doesn’t have the required funds in its Pin Payments account balance to process a refund.

If this is the case, there’s no need to worry, there are a few simple steps which will help you to continue processing customer refunds.

While our customer support team is still available to help you with your refunds, a method is now available that allows you to add funds to your account yourself.

To automatically transfer funds:

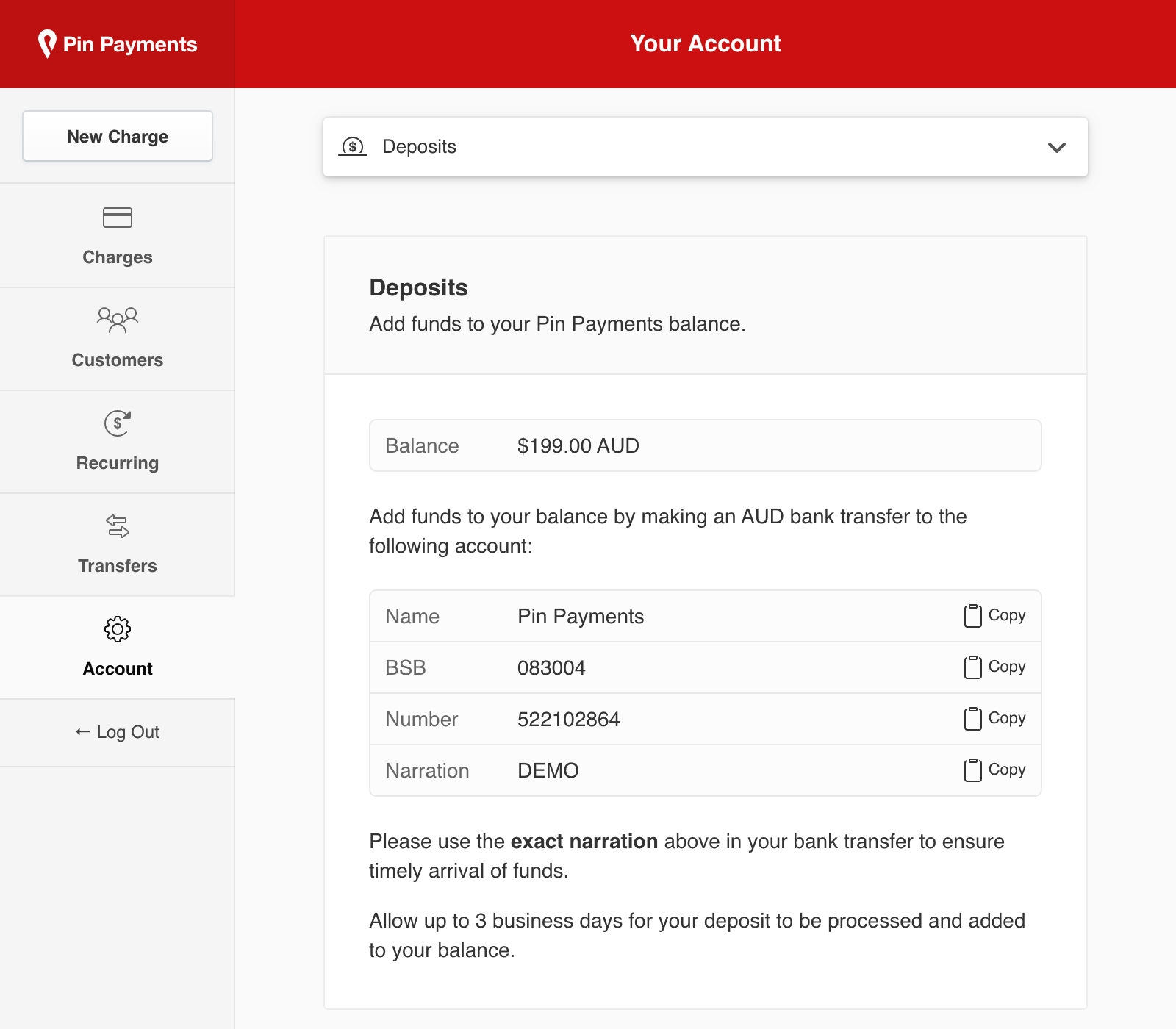

- Use the bank details found in your dashboard under Accounts > Deposits to transfer funds to your account (ensuring you include the narration in the transfer reference). An email with this same information will be sent to you following a failed refund attempt due to insufficient balance.

- Your deposit will be credited to your account balance, and your transfer schedule set to Manual (see below for information on this). An email will be sent to you to let you know your account has been credited.

- You will then be free to process refunds to your customers using the increased account balance.

Why your transfer schedule is set to manual

Normally, proceeds from charges you process are automatically transferred to your bank account. This is known as an automatic transfer schedule.

After the funds you’ve transferred are credited through this process, your transfer schedule is automatically switched to manual to prevent the funds from being transferred to your bank account, before you can submit the refund.

Once you’ve finished processing your refunds, you can switch your transfer schedule back to automatic.